How Tariffs Will Affect Auto Repair Shops (and What to Do About It)

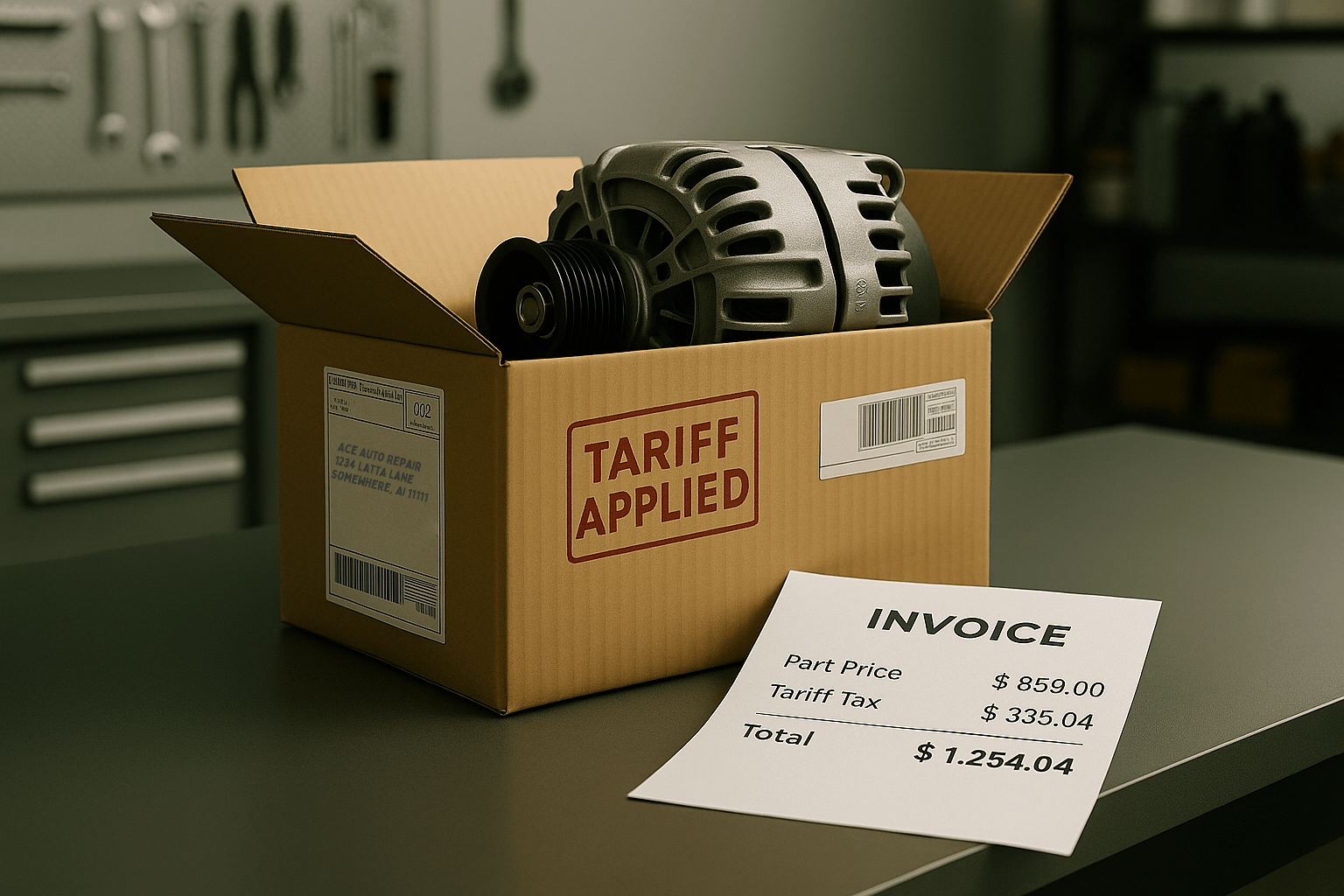

Tariffs aren’t just a headline—they’re a real cost hitting small business owners across the country. Whether you’re running an auto repair shop,...

Did you know that most businesses lose out on a significant amount of money each year by neglecting to take advantage of tax deductions? In fact, you could be missing out on huge savings — for example, a staggering 70% of small businesses eligible for the R&D Tax Credit fail to take advantage of it.

Those who take advantage report a significant impact — companies report seeing 'somewhat-to-substantial' results on their business's health when they utilize all of the deductions and incentives.

In the meantime, keep reading to learn more about the tax deductions your auto repair shop may be missing out on so you can act proactively for next year!

A tax deduction is an expense that reduces your taxable income, which in turn helps you save money on your taxes. For example, if you run an auto repair shop and earned $80,000 this past year but spent $20,000 on equipment (like a new ADAS repair system), you only have to pay tax on the remaining $60,000.

The IRS allows businesses to write off certain expenses as tax deductions. To maximize your tax deductions, you'll want to take advantage of as many opportunities as possible, like:

The IRS offers plenty of great opportunities for business owners of all industries to take advantage of their annual taxes. For auto repair shops, specifically, there are some tax deductions and credits you can use to help your business thrive financially.

As a business owner, you may feel overwhelmed when tax season arrives. In all honesty, most do!

On the upside, however, you don't have to be intimidated about filing your tax return as long as you understand what you can use as a tax deduction, how much you can deduct, and how to document expenses. It's also important to know how to avoid tax problems by keeping clean records and hiring a trustworthy accountant.

After all, there are many deductible expenses for an auto repair business. Like Shelby Friedman once said so inspirationally, "Tax time is when you test your powers of deduction!" And the auto repair industry has many for you to take advantage of.

Some of the most common deductions include:

With that being said, these seven auto repair shop tax deductions are often overlooked — but could save your business a substantial amount of money.

You can deduct the cost of vehicles and equipment used in your business or the depreciation amounts for those items. If you hire people to maintain, repair, or otherwise take care of your business's vehicles and equipment — go ahead and deduct that expense on your taxes! When it comes time to buy new tools for your business, make sure you track and claim their cost as an expense as well.

The IRS tax code gives business owners like yourself an opportunity to save a lot in the first year by writing off the cost of renovations, equipment, and other assets at once instead of over an extended period of time.

The trick to remember when looking to add either a loaner fleet or service truck to your shop is the requirements for those vehicles to qualify for full Section 179. The tests generally evaluate the vehicle based on gross vehicle weight, cargo capacity, and special-use features on the vehicle. Vehicles not qualifying may be considered “luxury autos” even if it is an economical vehicle like a Toyota Camry. The first-year depreciation is significantly limited.

You may have a company-sponsored 401(k) or SIMPLE IRA, in which contributions to that plan are deducted as wages paid to yourself. However, you may alternatively contribute to an Individual IRA or SEP (Self-Employed Plan), in which those contributions would need to be accounted for and deducted appropriately. Those contributions need to be made by 12/31 for a 401(k) or SIMPLE IRA and 4/15 for an Individual or SEP plan.

As a shop owner, if you have already contributed the maximum to your 401(k) plan, there is an opportunity for more! You could add a defined contribution or benefit plan — also known as Profit Sharing or Cash Balanced Plan — to contribute up to $61,000 in pre-tax dollars to a pre-tax retirement plan. While your 401(k) plan would need to be established before the end of the year, this contribution could be made on either 4/15 or an extended date of 9/15.

Tax deductions for business meals are intended to cover the business costs of taking clients or employees out to lunch and dinner. In the past, you could deduct 50% of all business meals you take clients or employees to, provided that they are directly related to business (as opposed to entertainment). This means that your meal must be focused on discussing specific topics on business matters.

However, for business meals consumed on-premises at a restaurant in 2021 and 2022, you are eligible to deduct 100% of the cost of the meal.

Note that you will need a receipt for any expenses related to these meetings, and keep in mind that meals taken home cannot be deducted under this category.

Professional memberships can also be tax-deductible. You might belong to an organization that trains people in the automotive field or provides services to help your business run smoothly. As long as the organization's primary purpose is professional and there is little socializing involved, it's probably a deductible expense.

Be aware: some organizations are structured to offer benefits like networking, education, and conferences but pay for them with nondeductible member dues. If you have questions about whether your particular membership qualifies, take a look at IRS publication 463. It lists examples of deductible expenses under "Education and Professional Development" (Chapter 1).

If you don't think you should be paying for something out of pocket, consult a tax professional. There may be other deductions you could get if you ask for them.

The Tax Cuts and Jobs Act greatly reduced the opportunity to itemize your individual deductions and to take a federal tax benefit for the state tax you pay — limiting the total deduction to $10,000 for all state taxes paid, IF you itemize. Many states now allow you to pay the state tax generated by your business at the business level rather than itemizing. This creates the opportunity to gain a federal tax benefit for the state tax you would normally pay personally, oftentimes savings of thousands of dollars.

Whether you operate a small auto repair shop or a large one, managing inventory is one of the most important aspects of your business.

As an auto repair shop owner, you undoubtedly have to keep track of various items in stock to conduct repairs on vehicles. The Internal Revenue Service (IRS) does not require that you maintain an inventory for tax purposes, but having an inventory system in place has many benefits for your business.

For starters, it can save you money at tax time because it allows you to claim certain deductions related to maintaining inventory. Another benefit is that it can help you streamline operations and increase efficiency by ensuring that you always have what you need on hand. This can reduce delays and lost revenue caused by downtime due to not having parts in stock.

An excellent example for auto repair shops, in particular, is Tekmetric's shop management system. The software features inventory management that allows you to:

Although the IRS determines what you can deduct on your taxes, there may be a few deductions available to you that you didn’t realize. It's important to understand what qualifies as a business deduction when you own an auto repair shop because it can save your shop money in the long run and help you operate smoothly through tax season.

If you aren't sure whether something is deductible or not, look up the list of qualified business expenses.

In the meantime, contact us to discuss all of your options with a trusted CPA. The key to taking advantage of tax deductions is partnering with someone who knows how to identify them for you and maximize their benefits for your business — and Kaizen is here to help!

Tariffs aren’t just a headline—they’re a real cost hitting small business owners across the country. Whether you’re running an auto repair shop,...

Do you feel like the software at your shop is slowing you down? What is the best software and is "the best" what is really best for you? Choosing the...

Looking at your shop’s financial statements once a year might be enough to get your tax return filed—but there’s a good chance you’re missing...