New Year’s Resolutions for Auto Repair Shop Owners

Every January, the same resolutions show up everywhere: eat better, stress less, save more money, work on yourself. Auto repair shop owners make...

Out of all of the important components of accounting that your auto repair shop needs to thrive in today's market, an income statement is among the top. Why? For a couple of reasons:

It all starts with being organized, and our team of automotive accounting experts at Kaizen is here to help you get started.

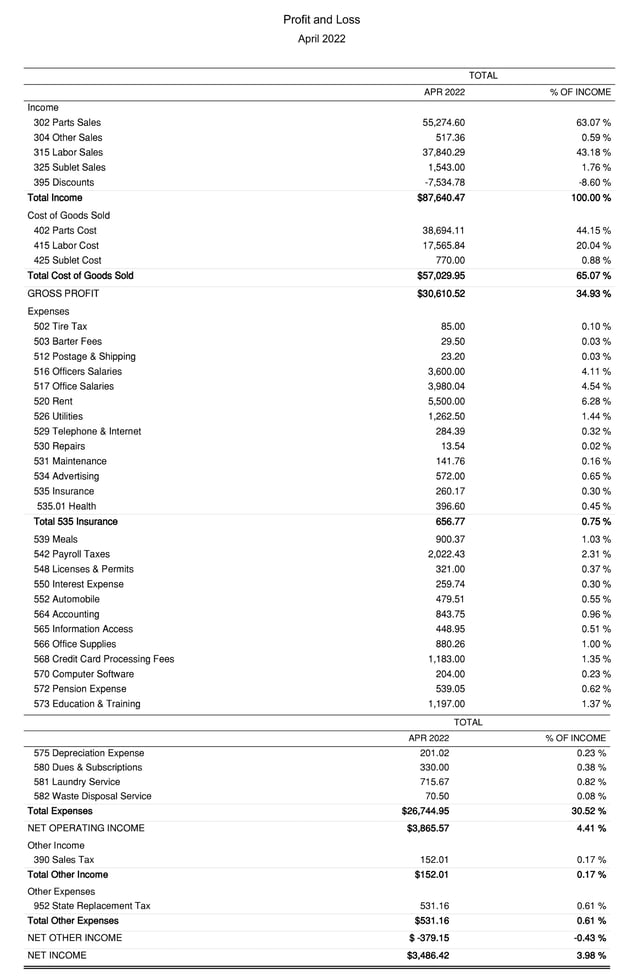

An income statement, also called a profit and loss statement (P&L), is an accounting document that shows the financial results of your business for a given period of time. In other words, it's a snapshot of what your company made or lost from day-to-day operations.

This crucial document provides you, your accountant, and investors (current and prospective) with the crucial information you need to know how well your company is performing monthly, quarterly, or, more often — annually. What's more, the report gives you a detailed analysis, including every expense linked to your profits and losses.

An income statement includes a list of all the money that comes in and goes out of a business. It's a snapshot of how much money your auto repair shop made or lost over a specific period of time, usually one year. It includes the following information:

Income statements are helpful because they show you what makes up your total sales, which is essential when deciding how much you're going to charge for labor and parts. In addition to giving you information about what you've earned and spent during any given year, the income statement highlights key ratios such as gross profit margin (GPM), net profit margin (NPM), and return on assets (ROA).

Here's a common format for an income statement:

To create an income statement for your auto repair shop, you will need to prepare a list of all income and expenses. Given the nature of the industry, there a number of unique aspects to keep in mind when organizing your auto shop P&L, including:

Parts & labor gross profit is a measure of the money left over after paying your parts suppliers and technician costs. These costs are unique to the auto industry and can make the difference between an accurate P&L versus one that ruins your financials.

These profit levels drive cash flow to pay overhead expenses and generate profits. The most common way to calculate parts & labor gross profit is:

Parts Revenue – Parts Cost / Parts Revenue = Parts Gross Profit

Labor Revenue – Labor Costs / Labor Revenue = Labor Gross Profit

With these metrics accounted for, your net income will tell you what your auto repair shop's profit is for that period after all other aspects of your accounting have been considered. This is crucial when calculating net profit margins, a telling metric for investors that shows whether your auto repair shop is profitable and its potential for the future.

It's completely up to you whether or not you want to hire an accountant. However, it is strongly recommended that you do so, especially if your business is more complex than usual. A professional who has experience with automotive shops will be able to help you get a better idea of how much money your business makes and where all of that cash is going.

After all, you can't do everything your auto repair specialists can do — at least not as efficiently without spreading yourself too thin. That's what experts are for, and accounting is no different!

Our team at Kaizen CPAs & Advisors is committed to efficiently taking over the tedious and time-consuming tasks that take up too much of your time but play a significant role in the success of your business. Click 'Let's Chat' today to book a call.

Find tools, guides, and more for auto repair shops: Accounting for Automotive Repair Shops

Every January, the same resolutions show up everywhere: eat better, stress less, save more money, work on yourself. Auto repair shop owners make...

A lot of shop owners aren't convinced a four-day workweek can work in auto repair. You need cars in bays, techs turning hours, and steady...

If you've been in any shop owner forum or watched car videos lately, you've probably heard about the “Montana LLC” trick. The pitch sounds simple:...