Save Big While Giving Back: Charitable Tax Benefits for Businesses

I’ve worked with a lot of business owners who love giving back to their communities. And honestly, that’s one of the best parts of running a...

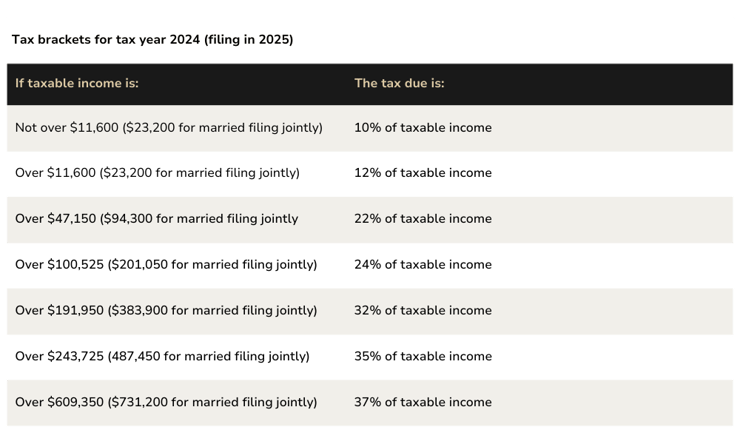

It might seem like a long way off, but where tax planning is concerned, earlier is better. To help us get a get a jump on our tax planning for 2024, the IRS has recently unveiled the updated income tax brackets and standard deduction amounts that will be applicable for the tax year 2024—relevant to the tax returns that most Americans will file in early 2025.

On an annual basis, the IRS makes adjustments to the tax brackets, standard deduction, and certain other tax benefits to account for inflation. The changes are intended to safeguard taxpayers from the impact of inflation. It's good to note that these inflation adjustments will not substantially alter an individual's tax burden and they don't put more money in our pockets. Instead, they merely prevent people from facing higher taxes in the event that their inflation-adjusted incomes (otherwise known as real incomes) increase by 7%.

Get ready for some good news when it comes to tax deductions! The federal standard deduction is set to rise in the upcoming year, giving individuals and married couples some financial relief.

For individuals and married couples filing separately, the new standard deduction for 2024 will be $14,600, a welcome increase from this year's $13,850.

Married couples filing jointly will also see a boost, with their standard deduction rising to $29,200 from the current $27,700. And if you file as head of household, you can expect a standard deduction of $21,900, up from $20,800 today.

Now, most taxpayers prefer to claim the standard deduction, but some choose to itemize their deductions. This is because when the total of their itemized deductions, like mortgage interest, charitable contributions, and state and local income taxes, surpasses the standard deduction, it makes more sense to itemize. So, if you anticipate your deductions exceeding $14,600 in 2024 as a single filer, you'll likely want to take advantage of itemizing to maximize your tax savings.

There are currently seven tax rates in the US federal income tax code – 10%, 12%, 22%, 24%, 32%, 35%, and 37% – that are applicable to different levels of taxable income, commonly referred to as tax brackets.

Let's take a moment to understand what taxable income really means. It's essentially your gross income minus any eligible tax breaks that you may qualify for. To give you an example, let's say you're single and earn $100,000 a year. However, after applying the necessary deductions, your taxable income amounts to $75,000.

Here's where it gets interesting – the first $11,600 of that will be taxed at 10%. Then, the portion of your taxable income between $11,600 and $47,150 will be taxed at 12%. Finally, any income between $47,150 and $75,000 will be taxed at 22%. It's important to understand these brackets to effectively plan your taxes for the upcoming year.

There are some noteworthy changes regarding Flexible Spending Accounts (FSA) and tax-advantaged retirement savings plans. If you have the opportunity to contribute to an FSA through your employer, you'll be happy to know that the IRS has increased the maximum savings limit for 2024 to $3,200, up from $3,050 in the current year, giving you even more tax-deductible income available to cover your out-of-pocket medical expenses.

The IRS also recently announced that individuals will be allowed to save more in their tax-advantaged 401(k) and IRA accounts. This is great news for those looking to boost their retirement savings and take advantage of the tax benefits these accounts offer. Be sure to check with your accountant or financial advisor to see how these changes can benefit you.

For more information on these and other tax changes for the upcoming year, visit the IRS website.

Stay ahead of the game and start planning your tax strategies early for a smoother financial journey in 2024.

I’ve worked with a lot of business owners who love giving back to their communities. And honestly, that’s one of the best parts of running a...

A new year is here, and for small business owners, that means new opportunities and challenges. Among the most important—and sometimes most...

With just over two weeks away until Tax Day, the Internal Revenue Service (IRS) is encouraging taxpayers to remain vigilant about the aggressive and...