How Payroll Scams Happen (and How to Prevent Them)

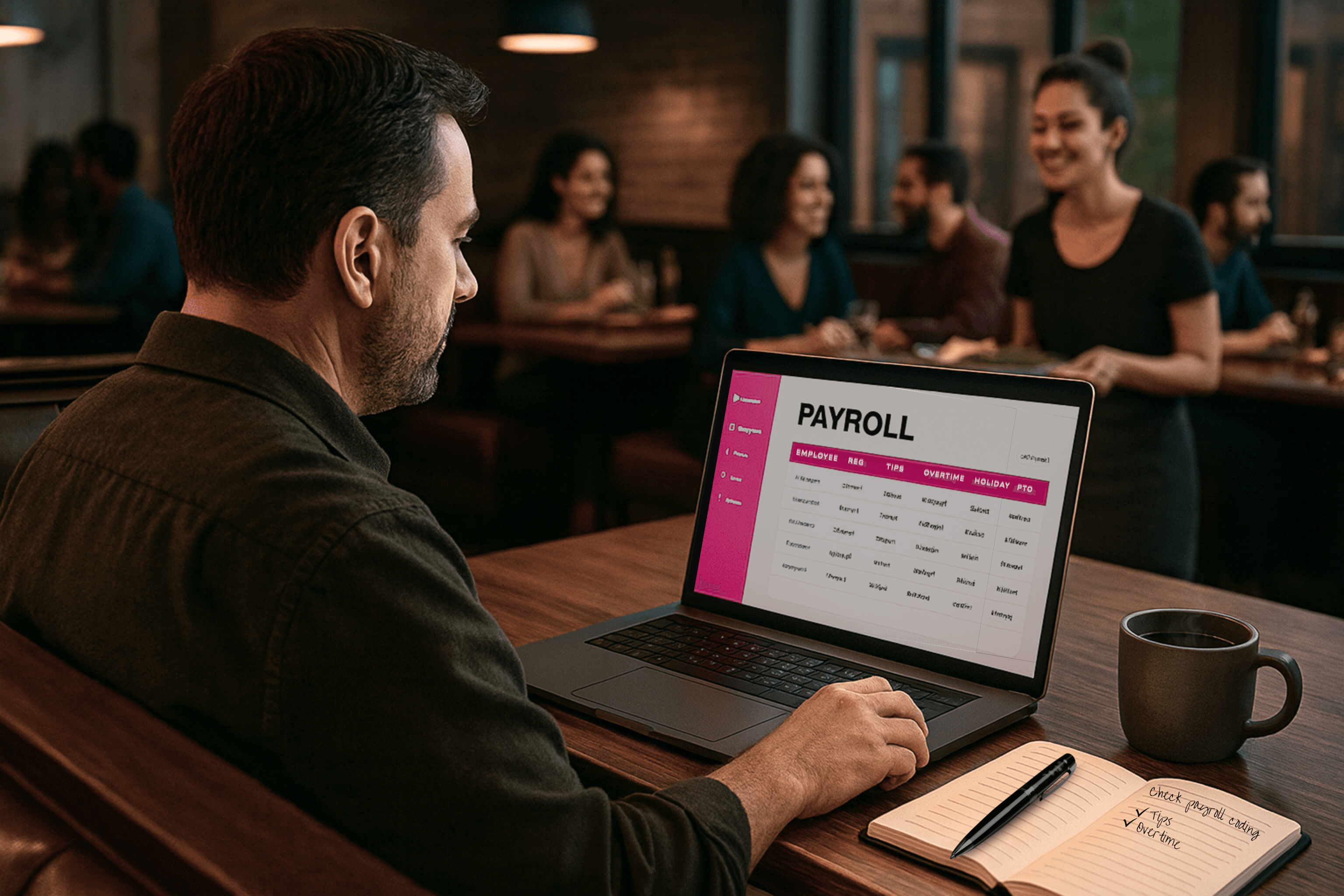

If you work with a payroll provider for your small business, payroll typically runs on a set schedule with very little day-to-day involvement from...

Actionable insights on payroll, taxes, cash flow, leadership, and growth planning — all focused on real-world decisions and better outcomes.

Join for the insights. Stay for the “oh, that actually helped.”

If you work with a payroll provider for your small business, payroll typically runs on a set schedule with very little day-to-day involvement from...

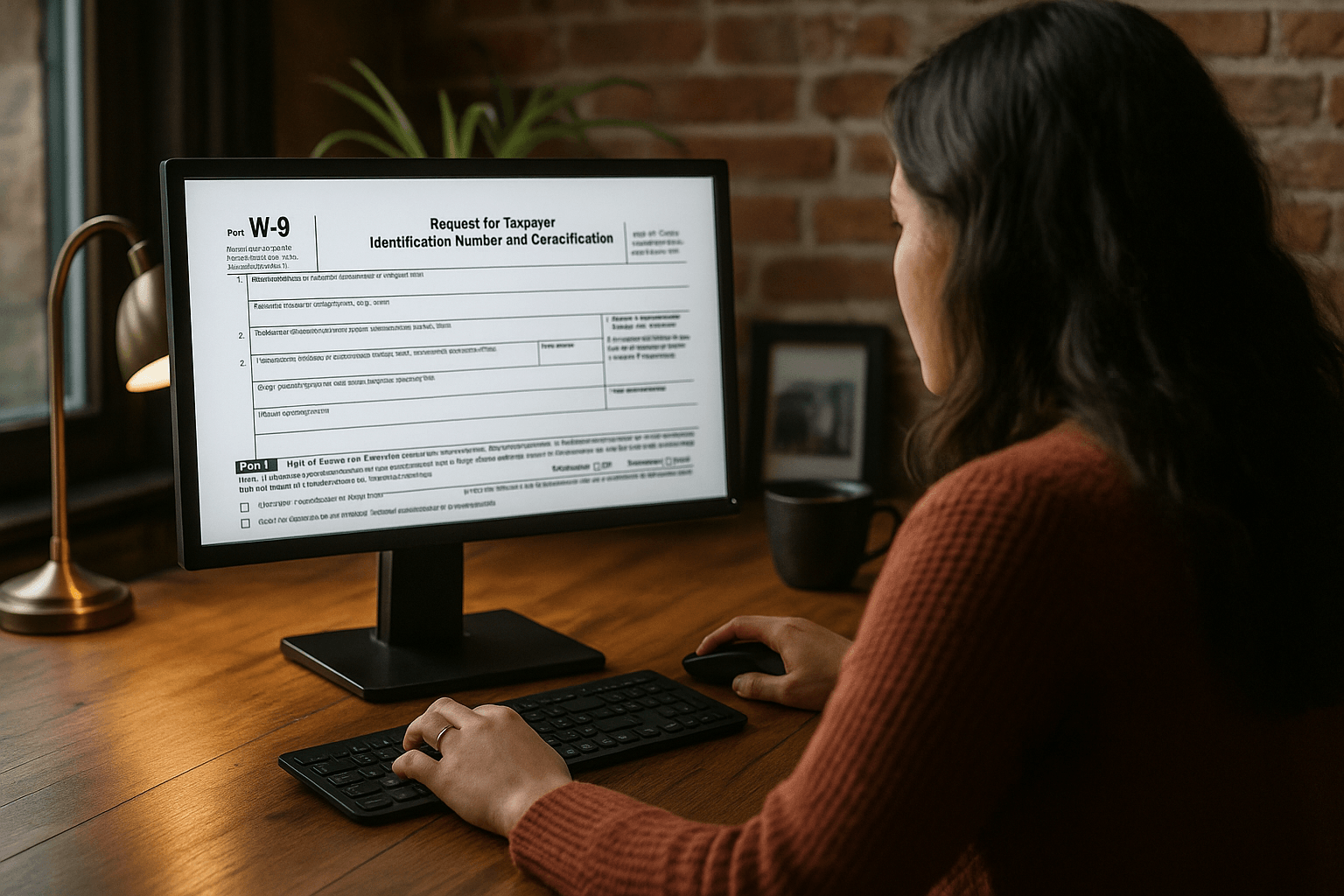

Not sure if you really need a W‑9 from that vendor you just paid? It’s a common question, and skipping it can lead to IRS penalties or filing...

Let’s face it, hiring can get messy fast. You’ve got applications coming in through your website, LinkedIn, maybe even someone’s cousin dropping off...

The One Big Beautiful Bill Act (OBBBA) brought in two new payroll-related deductions for 2025. They could be a real benefit for employees—but only if...

Hiring a contractor might seem easier—less paperwork, fewer costs. But what if that “contractor” is actually an employee in disguise? You could be on...

If you’re a small business owner, you’ve probably had to make some important decisions about payroll—whether to handle it yourself, use software, or...

If you run a business, you know how fast employee leave laws can shift. One minute, everything’s running smoothly, and the next, there’s a new rule...

Let’s set the scene: you’re running a business, you’ve got a mountain of work, and you need help. You bring someone on board, thinking, “Great!...

Overtime Laws Changed in 2024—Here’s How to Keep Your Business Compliant If you own a business, you already know that keeping up with payroll laws...

Running a business is no small feat—there’s always something to manage, and a Workers’ Compensation (Workers’ Comp) audit might be one of them. If...

As the year winds down, there’s more than just holiday cheer and New Year’s resolutions on the horizon. For small business owners, this time of year...

Retirement planning plays a crucial role in both supporting your employees' financial futures and keeping your business compliant with evolving state...