How to pick an insurance carrier for your small business

You have a ton of responsibility as a small business owner, but there’s one thing that often gets lost in the shuffle when you’re starting out that...

3 min read

![]() Brian Bride

| April 09, 2025

Brian Bride

| April 09, 2025

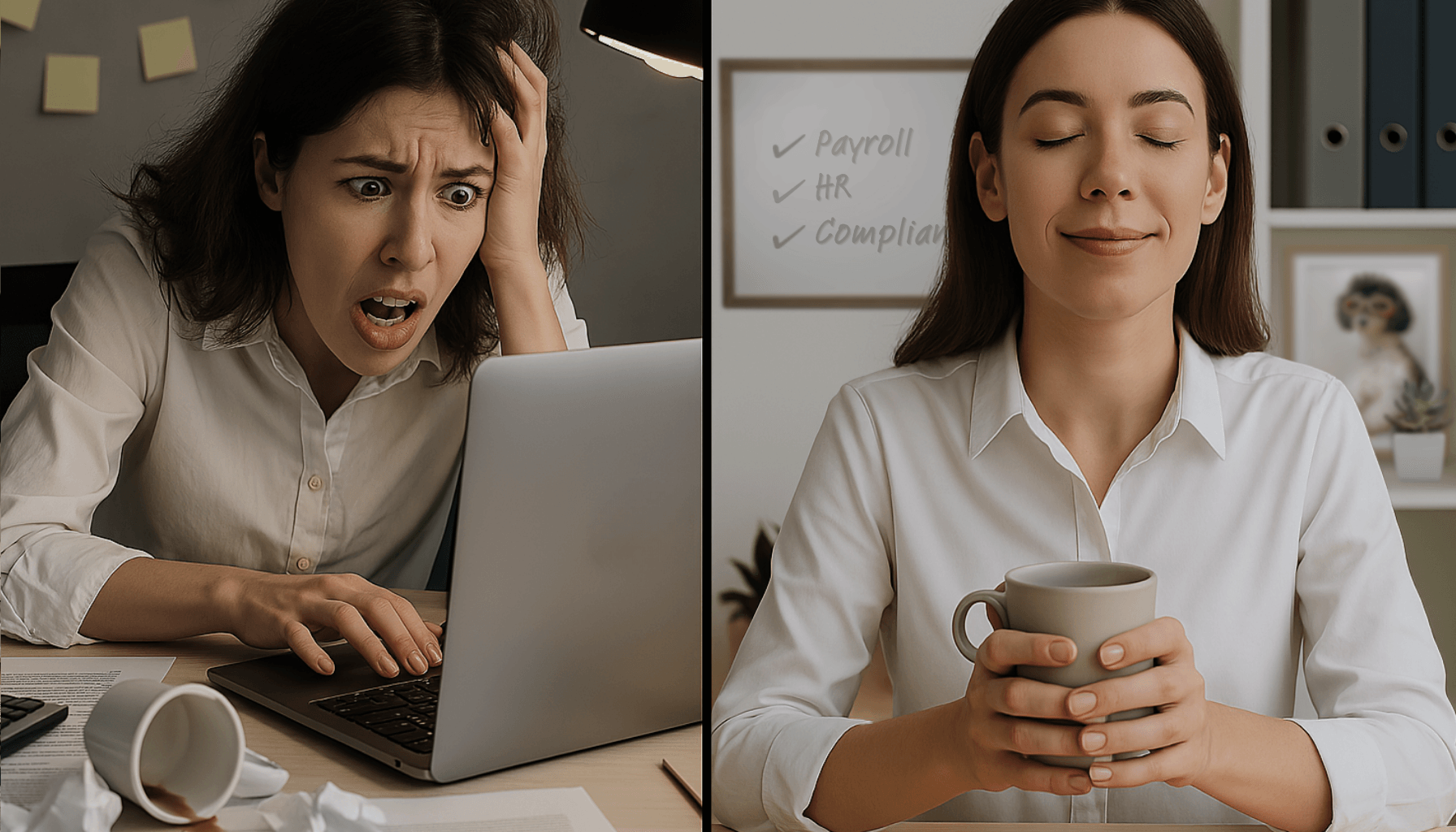

If you’re a small business owner, you’ve probably had to make some important decisions about payroll—whether to handle it yourself, use software, or outsource to a provider. There are a lot of payroll options for small businesses, and each one comes with its own trade-offs. What works for one business might not be right for another, especially as your team grows or your needs change.

So how do you know if outsourcing payroll is the right move for your business? Let’s take a look at what modern payroll services actually offer, what to consider if you’re thinking about switching, and how to tell if your current setup still makes sense for where you are right now.

At the most basic level, a payroll service makes sure your team gets paid accurately and on time. But the right provider offers much more than just processing paychecks—it becomes a key part of how you manage your people and protect your business.

In fact, a good payroll service can quietly take care of more than most business owners expect, including:

New hire onboarding, including digital I-9 and W-4 forms

Time tracking and PTO management

Wage and hour law compliance

Quarterly and year-end tax filings

Direct deposit, payroll tax payments, and W-2/1099 delivery

When everything’s handled in one place—with automation, reporting, and support from someone who knows what they’re doing and cares about you and your business—you’re not constantly putting out fires. You’re staying ahead of deadlines, avoiding costly mistakes, and getting time back to focus on your business.

Let’s talk compliance for a second. Because no one wants to be caught off guard by a letter from the IRS or a state labor department.

Wage laws, tax codes, and reporting rules are always changing—and if you're not keeping up, it’s easy to make a mistake that costs your business time, money, or reputation.

A strong payroll service doesn’t just handle the math—it keeps you updated on what’s changing and helps you take the next right step.

Some providers even handle wage garnishments, unemployment claims, and workers' comp reporting—areas where mistakes can get expensive fast.

So instead of losing sleep over whether you're “doing it right,” you’ve got a system (and ideally, a person) helping you stay ahead of the curve.

Most small businesses don’t have a full-time HR person. But that doesn’t mean the responsibilities disappear. Hiring, tracking time off, setting policies, documenting issues, and managing exits—those tasks still need to get done, even if HR isn’t your official title.

Many payroll providers now offer built-in HR tools that support small teams without adding more complexity. Instead of juggling separate platforms or manual processes, these tools help you streamline the admin side of managing your people—so you can spend less time buried in tasks and more time focused on your business.

Depending on the provider, that might include:

Onboarding checklists and self-serve portals for new hires

Customizable employee handbook templates

Time-off tracking tools with built-in reports

HR policy libraries that align with your state’s legal requirements

Reminders and alerts for compliance updates

Access to HR specialists when questions or issues come up

These aren’t just “nice to have” features—they can help you stay organized, stay compliant, and make employee decisions you won’t second-guess later.

When your attention’s already split in so many directions, this kind of support can make daily operations easier to handle—and a whole lot less reactive.

It’s a common concern. If you’ve been handling payroll in-house, handing it off can feel like giving up control. But in most cases, you’re not giving up control—you’re shifting the admin work to someone else so you can focus on oversight and decision-making.

When payroll is run by professionals (and backed by good tools), you’re still in the loop—but you’re not the one chasing down problems. You gain clearer reporting, fewer surprises, and more time to focus on your team and your business strategy.

And if something does need your input, you’re not starting from scratch. You’re working with someone who already knows your setup and can guide you through what needs to happen.

You’re stretched thin and payroll takes hours each week or month

You’re not sure if you’re staying compliant with tax deadlines or rule changes

You’ve made payroll mistakes that caused confusion—or cost you money

You feel uneasy about employee paperwork, policies, or documentation

Your current process isn’t built to scale with your team or growth

If any of that sounds familiar, you’re not the only one.

Most business owners start out managing payroll themselves—and it works.

Until it doesn’t.

Let’s take a closer look at how the responsibilities compare when you're doing payroll on your own vs. using a service:

We’re not here to sell you—but if you’re thinking about handing off payroll, it helps to know what kind of support is out there.

At Your Payroll Department (YPD), part of the Kaizen CPAs family, we’ve been helping small businesses simplify payroll and HR for over 20 years. We offer dedicated, proactive support—someone who knows your business, speaks your language, and is just a call or email away.

We’ve worked with shops, trades, and professional service firms across the country—and one thing we hear a lot is:

“I wish I’d done this sooner.”

YPD might not be for everyone—and that’s okay. But if you’re looking for a simpler, more personal way to handle payroll, we’re always happy to talk.

Whether you keep things the way they are or explore something new, the key is understanding your options—and how they affect your business.

You have a ton of responsibility as a small business owner, but there’s one thing that often gets lost in the shuffle when you’re starting out that...

4 min read

As your business grows and flourishes, keeping everything running smoothly takes more work. Every individual part of your organization’s...

Getting the best outcome at tax season is dependent on a few things, but there’s one that really sticks out: being on the same page as your...